Businesses across the UK that are already struggling thanks to surging inflation and its knock-on effect on the cost of living, may not be able to survive the consequences of being underinsured.

Our insurance advisors regularly speak about this issue with clients, highlighting that shops, factories, warehouses and many other commercial buildings across the country are likely to be woefully under protected in the event of a claim for damage. Never has this been more of a concern than it is today, where many businesses are already feeling possibly the biggest squeeze on finances in their history.

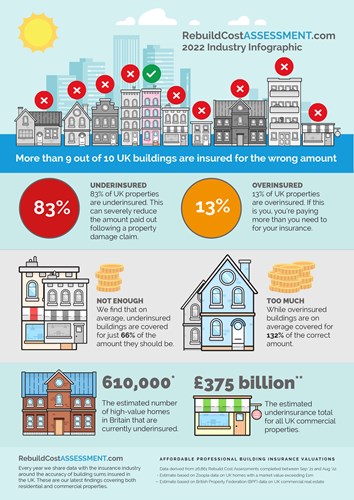

It is estimated that 84% of commercial properties in the UK are insured for the wrong amount*. In the vast majority of these cases, this is due to underinsurance which means that when a claim is made, the pay-out for the damage can be severely reduced.

UK HOMES ALSO UNDER UNDERINSURANCE THREAT

The concern of underinsurance isn’t exclusive to commercial properties. In fact, it is estimated that more than 90%^ of homes of significant value are also at significant risk of not being adequately protected – with the implications being seriously costly, perhaps even so costly homeowners could lose their home.

Towergate is part of the Ardonagh family of businesses, sitting in the Advisory platform, bringing together community-focused businesses. Commercial Director for Ardonagh Advisory, Mark Brannon says 'Now is not the time for businesses and individuals to find out their property is underinsured and that their insurance policy will not fully cover a loss'. At a time when every penny counts, it is our duty as insurance advisors to ensure the protection you have in place is adequate and will respond as you would expect it to in the event of a claim needing to be made.

‘Our advisors can organise property valuations by skilled CII, RICS and NEBOSH qualified surveyors, including a telephone-based desk-top valuation if required.’

Every year RebuildCostASSESSMENT.com shares data with the insurance industry around the accuracy of building sums insured in the UK. These are their latest findings covering both commercial and residential properties.

Data derived from 26,861 Rebuild Cost Assessments completed between Sep 21 and Aug 22.

*www.rebuildcostassessment.com – based on valuations conducted on more than 2,000 commercial properties every year

^www.rebuildcostassessment.com – based on valuations conducted on more than 3,000 homes of significant value per year