One of the biggest challenges that the insurance industry will face in 2021 is the change to the Civil Procedure Rules concerning Whiplash injury.

To explain the background, motor premium costs are far too high and the cost of whiplash claims to policyholders amounts to an average of £90 per policy. Therefore, the intention of the reforms is to significantly reduce, whiplash claims in order to save money.

Changes to whiplash injury rules

These changes will no doubt impact the way in which road traffic accidents are dealt with by insurers, and provide unrepresented claimants direct access to the new portal. This portal will allow individuals to manage their own claim, rather than rely on legal representation where the injury suffered in an RTA is minor with no complications.

During 2020, and into 2021, we are all adapting to the new way of remote working. This has also resulted in changes to our litigation system. For example, court hearings are being held remotely and this is likely to continue to be the case in the future.

The speed at which cases will be brought to court and the fact that hearings will be carried out remotely, will pose many challenges in assessing the credibility of a witness. Likewise, remote medical examinations may pose a threat to being able to successfully identify fraudulent claims.

The reforms involve dealing with simple road traffic accidents through different Ministry of Justice Portals, with each having differing protocols, impacting how insurers will need to respond.

Insurance implications of the whiplash reforms

We are in constant communications with our insurer partners to better understand the implications this will have. Many are reviewing their working practices to ensure they are ready for the new protocols. Only now that the new reforms are being introduced can insurers finalise their approach. The priority will be for them to scrutinise the new rules and related protocols, and be sure that systems, policies, and procedures are thoroughly prepared and tested.

The insurance industry will need our/your support to ensure only valid injury claims are paid and fraud is kept to a minimum. One crucial aspect of this will be obtaining our Policyholder’s/driver’s version of events, to include all available detail and a signed statement of truth to be collated immediately, the importance of ‘Day One’ Incident reporting has never been more crucial, to enable your insurers to make that liability decision within the 30 days required.

The difference being is if a liability decision is not forthcoming it will be assumed that the insurer has admitted liability and will automatically accept the claimant’s claim, but also where a claim is to be defended the insurers have to upload the collated claim detail including a signed statement of truth into the portal within the 30 days, there are a few very strict exceptions to this timescale but only for ‘good reason’ this being bereavement, sickness, holidays etc. In the event of one of these insurers will still have to prepare a witness summary to be served, so they will still need full incident circumstance, noting the statement of truth will still be required as soon as possible.

As a result, we cannot stress enough the importance of you reporting any motor incidents immediately on day one, regardless of how minor you deem the incident to be.

Motor insurance customer databases

It will be essential that the database is kept up to date with all the changes. This is to ensure claims are pursued against the correct insurers. On receipt of a claim through the portal, if the insurer is unable to re-direct, a signed statement of truth will be needed, causing additional work.

What are the whiplash changes from 31 May?

- The limit for Small Claims Track claims will increase from £1,000 to £5,000. If an individual hires legal representation to pursue their bodily injury claims below the £5,000 limit, their legal fees will not be recoverable from the compensating insurer. Minors, protected parties and any vulnerable road users will be exempt from this, as they will need assistance to pursue their claim.

- The insurance industry is expecting to see more unrepresented claimants known as Litigants in Person (LiPs) The ABI code of conduct will protect these individuals and it is now believed they will require extra support, which will increase the use of Claims Management companies.

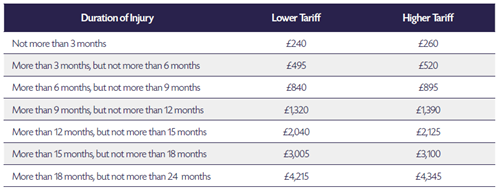

Introduction of two new tariffs (see table below)

- There is fixed compensation for “whiplash” type injuries, with a recovery period of up to 2 years. The tariffs are applicable to pure “whiplash” and include minor and psychological injuries. An uplift of up to 20% to the tariffs may be applied only in exceptional circumstances by a Court, where the degree of Pain, Suffering and Loss of Amenity (PSLA) makes it appropriate to use the uplifted amount.

Ban on Pre-Medical Offers

- Where injuries fall within the “whiplash” definition. There will be a ban in place, no longer allowing an offer to settle claims, without appropriate medical evidence

The Official Injury Claims (OIC) Portal goes live.

- This allows individuals injured in RTAs occurring on or after 31 May to use the portal to pursue a bodily injury claim

Medical Evidence

- This must be obtained for ‘whiplash injury’. Insurers are responsible for these medical experts’ fees Insurers

There will be liability disputes which may be a full denial of liability or partial denial. The new rules allow 30 working days for a decision on liability to be made***, after receipt of the Small Claims Notification Form.

This denial must be accompanied by

- Defendants version of events

- Signed Statement of Truth (legal document, any false detail could result in contempt of court proceedings)

***This is a fundamental change as insurers were allowed 3 months to obtain the signed statement of truth and investigate, this is now restricted to just 30 working days.

Insurers must have immediate access to drivers and their passengers.

When liability is not accepted, the new rules entitle the claimant/plaintiff to start legal proceedings. Drivers and witnesses will be required to attend court in person, (subject to Covid restrictions), to provide their version of events, in a liability-only litigation hearing.

Where liability is accepted, but the injury is questionable, such as low speed impact claims, insurers can accept liability, i.e. primary liability, but not admit that any injury was sustained.

The insurer must ensure they have the version of events and a statement in support. These must be passed to the medical experts for consideration, during the medical assessment. Concerns can be raised following any completed medical assessment, but insurers are liable for the cost of the medical report for unrepresented claimants.

Insurers can defend fraudulent claims as they do now and the cost of doing so will remain unchanged. However, this may be disproportionate to the cost of the injury claim itself. It is helpful that the insurer’s concerns will now be known by the medical expert.

Insurers will still need to ensure they select the right cases to defend, ensuring they have the required signed statements of truth within the 30 working days.

New first notification of loss app

To help you, as our policyholder, we have procedures in place to speed up the reporting of your motor collision, including a First Notification of Loss App to download onto your drivers’ phones, ensuring that the incident report comes to you/us & insurers immediately.

Please ask your usual Towergate adviser for more details about accessing the Towergate Firstcall App, available on Apple/iOS and Google Play/Android.

Motor insurance from Towergate

Our motor insurance aims to insure those who might otherwise be overlooked by regular insurers.

Fleet and commercial vehicle insurance from Towergate

We can arrange specialist fleet insurance for commercial vehicles of any type, size or composition to include trucks, vans, cars, buses, coaches, taxis, HGVs and more.

About the author

About the author

Mark Brannon Cert CII is a respected industry leader with over 17 years’ industry experience in a variety of roles within the business insurance sector. He works across a wide spectrum of insurance product and policy development, delivery and optimisation for clients, including claims, insurer relationships, marketing and communications, and risk management.

Read more Health and Safety articles

- Health and Safety Covid Spot Checks - is your Business Prepared?

- Health and Protection COVID-19 information hub

- Health and Safety and Employment Law advice ahead of returning to work

The information contained in this bulletin is based on sources that we believe are reliable and should be understood as general risk management and insurance information only. It is not intended to be taken as advice with respect to any specific or individual situation and cannot be relied upon as such. If you wish to discuss your specific requirements, please do not hesitate to contact your usual Towergate Insurance Brokers adviser.