We want to share an exciting update with you – this November, we will be rebranding to our new name, Everywhen.

News and Insights

The late Roald Dahl would have turned 109 on 13 September, as we honour a legacy of stories that have captivated young readers around the globe for decades.

This article is intended to support those that could be affected by the current events similar to the protests, riots and civil commotion in August 2024.

If you’re in charge of security for public venues or events, it’s likely you’ve heard of Martyn’s Law, which received Royal Assent on the 3rd April 2025.

In July 2025, the Institution of Civil Engineers (ICE) unveiled a renewed safety action plan, prompted by escalating concerns over infrastructure safety stan...

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated, impacting individuals and businesses alike.

As the kids prepare to go back to school, now's a great time for parents to do a little preparation of their own. Part of that is having insurance cover in p...

It’s a fair question. With cybercriminals increasingly targeting the public, you might wonder as to whether your home insurance would cover any financial los...

In an age of carbon calculators, zero-emissions targets and heated debates over petrol bans, classic cars might seem like the antithesis of environmental res...

As the workplace continues to evolve, flexible working is no longer a perk or a nice-to-have - it's an expectation, especially among younger generations

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated, impacting individuals and businesses alike.

If you need to make a claim following storm damage, we’ve listed some steps and tips below for your consideration.

If you need to make a claim following storm damage, we’ve listed some steps and tips below for your consideration.

To help you keep you safe when operating commercial vehicles, we’ve compiled some tips from the AA and AXA.

If you need to make a claim on your commercial vehicle this summer, it pays to be prepared...

With flooding expected across the UK, it’s important to take precautions to keep your business, people and customers safe.

We understand how disruptive flooding can be and are here to support you through the inspection and claims process.

We understand how disruptive flooding can be and are here to support you through the inspection and claims process.

With flooding expected across the UK, it’s important to take precautions to keep your family and assets safe.

From historic riverside inns to tucked-away countryside spots, here are ten of the best canal-side pubs in the UK to moor up or wind down.

We take a closer look at online insurance calculators and explore why relying on them can be risky.

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated, impacting individuals and businesses alike.

Imagine launching your dream business, only to lose it all over a single client dispute. For many start-ups, this can be a harsh reality.

Did you know that the UK is supposedly one of the most haunted countries in the world? It’s true – we have the most reported ghost sightings per person.

Thirty years ago, the idea of your home being controlled by a polite talking portal would seem ludicrous but now – it’s totally normal.

In late April 2025, Marks & Spencer suffered a cyberattack which disrupted both its online operations and in-store services.

If you’re about to set off on your holiday, it’s important to have travel insurance in place in case anything goes wrong while you’re away.

If you’re a landlord buying commercial or residential properties to let, the risk of underinsurance is something you need to be aware of. In this article, we...

Founded in Rome in 1925, Fendi started out as a small workshop specialising in leather and fur. Over the decades, it has evolved

When it comes to arranging your insurance as a small business, you may come across some terms you’ve not heard of before.

The core principles of fire safety management in residential buildings are the same as in any building – but with key differences.

As technology continues to evolve, so do cybercriminals and their cyber-attacks on businesses and individuals.

When it comes to your business insurance, a key term you may come across is “professional indemnity (PI)”. But what is it and why is it important to have?

To help you stay one step ahead of cybercriminals, we’re exploring a different aspect of cybersecurity each month in 2025 as part of our bitesize series.

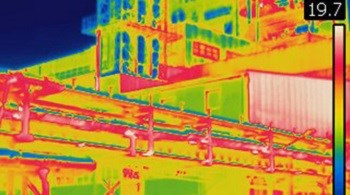

With temperatures predicted to soar across the UK in the coming days, it's important to take precautions to keep your business, people and customers safe.

Over the years, the NHS has faced challenges across many of their key services, creating significant strain on our national healthcare system.

With life-altering sums on the line, underinsurance is a legitimate epidemic that can – and does – devastate lives and businesses.

If you own a second home in an area that attracts tourists, you might have considered renting it out to holidaymakers while it’s vacant.

Wimbledon. Widely considered the biggest tournament in tennis, it attracts over half a million guests through its gates during the 14-day event, and that’s b...

With the emergence of artificial intelligence (AI) in recent years, more and more people are using it to get answers to their everyday questions.

On 28th April 2025, Spain experienced a power outage that led to blackouts across the country while also affecting Portugal and parts of France.

According to a recent survey conducted by Aviva, one in five UK businesses have experienced an incident connected to lithium-ion (Li-ion) batteries, such as...

Making a claim as a small business should be a simple process, but sometimes, it might not be paid out in full, or at all.

When you register your business, you have some choices to make as to what sort of company you will be. Most small businesses in the UK are either registered...

Historically, small and medium-sized businesses have been disproportionately impacted by cybercrime compared to larger companies.

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated, impacting individuals and businesses alike.

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated, impacting individuals and businesses alike.

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated and impacting individuals and businesses alike.

As of Sunday 6 April 2025, businesses have seen an increase in employers’ National Insurance contributions (NICs), rising from 13.8% to 15% on salaries above...

Trouble can arise unexpectedly for any business, forcing you to cease operation and potentially losing you a lot of money. This is why it’s important to have...

In 2024, 47% of microbusinesses and 58% of small businesses identified a cyber breach.

Driving a dirty car itself has no impact on your car insurance, but there are some things that you need to watch out for before you set off if your car is lo...

Over the past couple of years, the world has watched as artificial intelligence (AI) and deepfake technology have rapidly advanced, bringing with them a whol...

The upcoming Cyber Security and Resilience Bill is a major change in legislation, aiming to improve the nation's cyber defences. But what does it mean for yo...

The cyber threat landscape is rapidly evolving. It is becoming increasingly sophisticated and impacting individuals and businesses alike.

From 6 April 2026, significant changes to Business Property Relief (BPR) and Agricultural Property Relief (APR) will come into effect, changing how these tax...

Supply chain disruption has recently become a global issue for businesses and is thought to be caused by a culmination of factors.

Did you know that, on average, properties are only covered for 63% of the value they should be?

In 2024, BT revealed their decision to withdraw their Redcare alarm signalling services from the market completely by 1st August 2025.

Supply chain disruption has become a global issue for businesses in the last few years especially and it can be caused by a variety of factors.

Financial wellbeing is the feeling of being in control of your finances, having the ability to manage day-to-day expenses, save for the future, and handle un...

When Kimberley Pettit joined Ardonagh as an apprentice at just 18, she wasn’t entirely sure what to expect. Now, three years later, she’s an account handler...

Lithium-ion (Li-ion) batteries are used to power e-bikes, electric vehicles and other portable devices that we use in our everyday lives. However, if stored...

In this article, we look at the potential hazards of solar panels, so you can stay knowledgeable about the risks if you’re looking to install solar panels on...

The cyber threat landscape is rapidly evolving. It is becoming more sophisticated and impacting individuals and businesses alike.

Following the COVID-19 pandemic, the supply chain landscape changed hugely. Some organisations which previously relied on international suppliers turned to l...

You’ve been living alone for a long time, hoping one day for some companionship. And then, just like that, you find the person of your dreams on a dating sit...

On Friday 31 January 2025, Barclays customers experienced intermittent errors following significant IT problems that affected the bank’s app and online banki...

The cyber threat landscape is rapidly evolving. It is becoming more sophisticated and impacting not only individuals but businesses as well. To help you stay...

Demand for solar power has soared as we unitedly work toward a carbon-free future. However, concerns have emerged highlighting the risks of solar photovoltai...

Since 26 October 2024, employers now have a new legal duty to take “reasonable steps” to prevent sexual harassment in the course of employment.

A cultural shift has seen an uptick in solid fuel appliances in restaurants and other commercial kitchens. But while these appliances can spice up your menu...

Every year, up to 4,000 people in the UK are admitted to the A&E with carbon monoxide poisoning, with a further 200 hospitalised, and around 60 fatalities.

As a landlord, you have responsibilities towards your tenants, and one of those responsibilities is to help keep them safe with the use of carbon monoxide de...

After a disaster-filled Christmas Eve, Father Christmas realises the importance of having adequate travel insurance in place.

It may be said to be the most wonderful time of the year, but Christmastime comes with a whole host of risks. We take a look at twelve of the most common per...

Last year, cybercrime cost UK businesses £30 BILLION . This is a £3 billion increase from 2022. Cyber criminals are constantly finding inventive new ways to...

Floods can occur at any time during the year. That's why it's never been more important to invest time into creating a flood plan to protect your property an...

Winter isn’t just cold - it’s often windy and stormy, too. And with wind often comes wind damage. Read on to find out more about the possible damage that win...

As the months get colder, they bring with them snow and ice - which can be damaging to your property if you’re not prepared for them. Read on to find out mor...

Power outages: while we usually don’t know when they’re going to happen, there’s one thing we do know – with the colder seasons approaching, extreme weather...

As the nights draw in, defrosting our cars will soon become part of our morning ritual. Inclement weather can make driving even more hazardous than usual. Di...

With winter around the corner, it’s time to start thinking ahead and preparing for the many ways you could be impacted by inclement weather. High winds, plu...

When you picture winter, what do you think of? The season conjures up images of warming our hands by cosy fires, hot chocolate on long snowy walks and decora...

Winter weather in the UK can be unpredictable, resulting in hazards like snow, ice, and flooding. Even for the most experienced drivers, journeys can become...

Who doesn’t love a good deal? Every year on Black Friday, shoppers flock to high streets, shopping centres and the online market to score everything from gro...

As the days get colder, many of us will choose to turn on portable heaters or other heat sources in order to keep warm.

As the darker nights draw in, we look forward to the festivities that greet us each year during autumn.

With winter just around the corner, it’s important to make sure your commercial property is ready for the colder months.

Prompted by a recent sharp increase in laundry room fires, our colleagues at Stallard Kane have created the following guide on how to prevent the worst from...

From 1st October 2024, the London Fire Brigade has said it will no longer respond to automatic fire alarms at most commercial properties between 7 am and 8.3...

Preparing your business for an event that hasn’t happened yet might sit at the very bottom of your to-do list, but consider this: up to 40% of businesses do...

Fire is a risk in almost every workplace, but hot works are a particular leading cause of workplace fires. In this article we take a closer look at hot works...

Today, the e-bike – or electric bike – is the most popular bike on the market,[1] but their surge in popularity has been accompanied by incidents of fire and...

If you were one of the many businesses that were affected across the globe when CrowdStrike’s update caused a large scale outage of key internet systems, or...

This article is intended to support those that have been affected by the current events. If you have been impacted by the recent events and suffered loss or...

Safety labels and signs are important for employers because they help them to meet health and safety requirements. There are other benefits as well; such as...

An insurance policy should be there for you when you need it, and provide peace of mind in the background the rest of the time.

Unfortunately, one of the downsides to living in the UK is the unpredictability of our weather. Or actually, the predictability of our weather - where it fee...

It’s officially British summertime, but unfortunately, the great British weather doesn’t always reflect this. It means, that from time to time, we do see flo...

In the corporate world, ‘packaging’ is anything used to hold, protect, handle, deliver, and present goods – from raw materials to finished goods.

If you’re an obligated packaging producer with packaging producer responsibility, you have a legal duty of care when it comes to disposing of waste.

We spoke to Paul Farmer, Head of Technical at RiskSTOP Surveys Ltd, about the emerging risks associated with roof mounted solar panel systems.

Let’s explore how companies can best support onboarding for long-term retention.

How hot is too hot, and do you have the necessary adjustments in place to keep your employees safe in heatwaves?

Have you read our recent Q&A with Towergate’s cyber expert, Marc Rocker? Here we ask him what the most important things are to look for with your cyber insur...

In this Q&A we discuss all things cyber security with Marc Rocker, Head of Cyber at Towergate. To talk about cyber insurance for your business or your place...

Implementing a robust Health & Safety Management System benefits any business. It provides a structured approach to identifying and mitigating risks, fosters...

In workplace safety, some risks are obvious and tangible – but what about the ones that lurk beneath the surface, invisible to the naked eye?

The National Minimum Wage came into effect with the implementation of the National Minimum Wage Act 1998, with the aim of reducing ‘poverty pay’ and the inco...

With a combination of school holidays and the first of the Spring-time bank holiday weekends, the Easter break typically see many of us travelling for holida...

At Towergate, we regularly have conversations with our clients about how they can defend against cybercriminals seeking to exploit their company. In the proc...

With 350,000 new malicious programmes being discovered every day[1], there’s been a big spike in cyber crime and as a result we’re seeing an increase in cybe...

From honeypots and logic bombs to vishing and social engineering, the cyber world is filled with often puzzling jargon. In this article, we demystify a few k...

In today's digital age, businesses of all sizes rely heavily on technology and the internet to operate efficiently and reach a wider customer base. However,...

The best way to keep your data safe while travelling is not to bring your mobile devices with you at all, but sometimes it’s unavoidable. In this article, we...

New guidance issued by the Equality and Human Rights Commission (EHRC) states that if a woman experiencing menopausal symptoms has a substantial or long-term...

According to the Health and Safety Executive, slips, trips and falls (on the same level) are the single most common cause of major incidents in UK workplaces...

You may have seen media reports over the last year or so concerning BT’s decision to withdraw their Redcare alarm signalling services from the market complet...

Fire safety is a significant concern for every responsible business owner, prompted not just by legal obligations but also by the well-being of employees and...

As part of several employment law updates anticipated throughout 2024, legislation surrounding paternity leave is expected to change from 6th April.

Over the last few decades, the business’s role in the world has changed. Whereas before business owners were responsible for the safety and wellbeing of its...

You may have heard the phrase “forever chemicals” or “PFAS” in the headlines recently, but what are they and what risks do they pose to us and our environmen...

In the UK, there are around 22,000 workplace fires every year. That’s an average of 423 fires per week in the workplace alone.

Did you know that frozen or burst pipes are among the most expensive insurance claims made during the winter?

High winds, plummeting temperatures, heavy rainfall and snow combine to create a dangerous scenario that can impact your home, your business, and yourself. E...

Asbestos risk in any premises, particularly those built before 2000 when asbestos was still common in a whole range of building materials, must be managed co...

First Aid at Work trains candidates to become qualified first aiders who can apply learned techniques on a casualty in the vital moments before the emergency...

Consultation should not be seen as a formal process usually connected with disputes but rather as a key part of an employer’s day-to-day management skills. E...

When running a business and employing individuals, there is a fundamental responsibility that should never be overlooked – health and safety.

Spark erosion machining — also known as electrical discharge machining (EDM) and, in its conventional form, die sinking — is commonly used in engineering to...

As the colder months approach, it’s imperative to weatherproof your house to minimise damage and reduce costly claims. We’ve pulled together five ways to kee...

With some parts of the UK witnessing their wettest October on record this year and several storms hitting in the UK in autumn already , it’s safe to say the...

Whether you’re taking on a route you’ve done many times before or heading to a new trail for the first time, getting outside in winter is good for the mind,...

In September 2023, the Welsh Government implemented 20mph speed limits on all residential streets throughout Wales. This move is part of the Welsh Assembly’s...

There’s certainly more of a chill in the air, and as the weather changes to an icier feel, other factors should come into consideration such as your own well...

The Workers (Predictable Terms and Conditions) Act 2023 was passed in September 2023. Although no date has yet been set, the introduction of the Regulations...

The annual death rate in the motor vehicle repair industry is 1.6 deaths per 100,000 workers — around four times the average rate across all industries. So,...

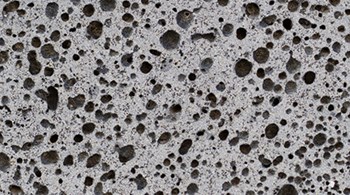

The vast majority of people were unfamiliar with RAAC until very recently, when headlines of sudden school closures linked to the material brought it into pu...

If the wintry weather hasn’t quite arrived yet, then it’s certainly on the way! The question is, are you prepared, and do you have the necessary cover in pla...

There has been a huge increase in the awareness of neurodiversity across the globe, with a corresponding increase in understanding, acceptance and inclusion....

With 2023 studies showing almost a third of employees have experienced workplace bullying, we wanted to check in with our clients to provide a refresher in h...

If you’ve dealt with an employee who’s been on sickness absence, or one who’s experiencing a long-term disability or medical condition, you may have come acr...

As students have now returned to their classrooms, drivers must be aware that there will be an increased presence of pedestrians and traffic on the roads.

Fire doors help contain fire and smoke to the area where it originated and help keep access routes, corridors, and fire exits clear for longer to aid escape....

To ensure that tips intended to reward staff for hard work and good service are distributed fairly and transparently, the Government supported a Private Memb...

A recent BBC Panorama programme reported on the significant increase in adults being incorrectly diagnosed with Attention Deficit Hyperactive Disorder, more...

If businesses need to invoke their Incident Response Plan (IRP) there is a possibility that this will be as a result of losing some or all of their primary i...

Whatever your business, you’re going to be open to a wide range of risks, also known as Errors & Omissions (E&O). In this article, we look at E&O insurance,...

In addition to potential electric vehicle problems of charging availability and range, there is an issue which is now receiving increasing press coverage, wh...

A Permit-to-Work system is a formal recorded process used to control work which is identified as potentially hazardous. The aim of using a Permit-to-Work sys...

Under the Equality Act (2010), employers have a legal obligation to offer support to any employee who has a disability, defined as a physical or mental impai...

A foreseeable risk is a situation which could result in injury or damage, and which could be predicted by a reasonable person with the necessary skills and k...

There is nothing quite like a British heatwave - but ensuring you stay safe as temperatures soar takes more than just a decent sunscreen. You have a duty of...

Asbestosis is not the historical disease people often think it is. In fact, The Health and Safety Executive (HSE) has said asbestos remains the biggest cause...

In the last few years employers have helped bring about significant changes in working practices, with many businesses adopting a greater flexibility to the...

If health and safety measures in the workplace aren’t performing, then the repercussions can be significant.

A risk assessment lists the hazards that might be encountered while completing a task or activity, or being within a certain environment.

Can an employer lump together a series of minor acts of misconduct and use that as a reason to dismiss an employee without prior warning? And if they do, is...

Within many organisations, there will be trades that may require work away from their premises. Work away can routinely involve both low and/or high-risk act...

Running a successful business requires more than just hard work and dedication; it also means staying up to date with ever-changing employment law legislatio...

Health and Safety has an image problem – it’s often portrayed as a burden on businesses, with oppressive regulations that have little to do with common sense...

Long-term sickness is a period of continuous absence lasting four weeks or more. Managers often need clarification on what support they are required to offer...

Our sister company, Towergate Health & Protection, investigate potential risks for your business with the introduction of the new consumer duty rules.

Our sister company, Towergate Health & Protection, investigate how the new Consumer Duty rules will impact your business.

Are you considering setting up a CCTV system to monitor what your employees are doing? Have you considered the drawbacks that might ensue and are you prepare...

BT Openreach, who manage the UK landline telephone network, is now part way through their ‘All Internet Protocol (IP)’ programme whereby the traditional copp...

There are a four main types of movement that can have an impact in your home: subsidence, settlement, ground heave, and landslip. In this article, we investi...

A number of factors have coincided to mean that rebuilding costs have hit record highs and the risk of underinsurance is now greater than ever.

Our sister company, Towergate Health & Protection, suggest that being on a budget doesn’t have to limit your summer fun. There are still plenty of ways you c...

The use of electric and hybrid vehicles (E&HVs) is expected to increase, with greater availability and increased driving range.

A year ago, virtually nobody outside the world of AI had heard of ChatGPT. Now, it and its fellow applications seem to be everywhere and there is no doubt th...

Every business relies on third-party technology to some extent, exposing tech companies to a wide range of potential errors & omissions (E&O) or professional...

Our sister company, Towergate Health & Protection, advise that nurses and doctors have been intermittently striking since late 2022 in what’s been called a ‘...

In the 1950s the UK had one of the highest life expectancies in the world, ranking seventh globally. Today, we rank at just 29th.

The devastating impact of construction dust on workers' health is alarming, with numerous individuals suffering from chronic illnesses and loss of life.

Our sister company, Towergate Health & Protection, advise that B Corp certification is highly coveted, and for a reason. Businesses are awarded B Corp certif...

Various business protection solutions can help provide the financial means to help your business.

As of 1 July 2023, firefighters in Scotland will no longer respond to automatic fire alarms in commercial premises in an effort to reduce the number of unnec...

We are aware of recent reports in the media that groups of Russian based hackers are potentially planning to attack the Swift Banking System, used globally b...

When you run a business, no matter its size, there are many things you have to juggle – never more so than when it comes to cashflow.

In this guide, we explain the scope of a crime policy, what might be insured or partly insured under other policies, and commercial factors that may also lea...

The government recently announced their intention to scrap the lifetime allowance (LTA) tax charge on pensions. But our sister company, Towergate Health & Pr...

The fire risk of lithium-ion batteries continues to raise concern amongst health & safety specialists and insurers.

In the drive towards achieving environmental sustainability and energy efficiency and we are seeing an increase in the use of Solar Panels/Photovoltaic Cells...

The pandemic prompted many people in the over 50s age group to reassess what was important to them and many quit their jobs as a result. But the cost-of-livi...

Although the days of the pandemic are behind us, homeworking is here to stay. Here we detail five top tips for employers when it comes to supporting employee...

Today, the populations most heavily exposed to asbestos are those in construction trades. However, because asbestos can cling to clothes, someone in the con...

Ransomware has been a key issue for UK business for several years now and we have seen the landscape change from high volume attacks asking for relatively sm...

SK Risk Solutions complements Stallard Kane’s Health & Safety, HR & Employment Law and Training services, offering a comprehensive solution to help keep ever...

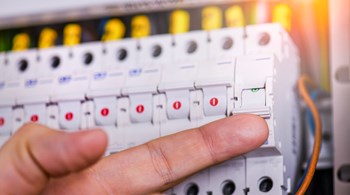

The first of three blogs from Stallard Kane regarding Electrical Installation Condition Reports.

The second of three blogs from Stallard Kane regarding Electrical Installation Condition Reports.

The third of three blogs from Stallard Kane regarding Electrical Installation Condition Reports.

Last year, our Prime Minister proclaimed a bank holiday in honour of the coronation of His Majesty King Charles III. The bank holiday will fall on Monday 8th...

On 22nd May 2017, Martyn Hett was one of 22 people killed in a terrorist attack. Over 1,000 more were injured when suicide bomber Salman Abedi detonated a ho...

Corporation Tax for companies with profits of £250,000 or more increased from 19% to 25% on 6 April 2023. This means that the majority of businesses in the U...

When it comes to motor trade insurance, there are some key things that could affect policies. It is important to recognise and understand these if you are in...

One challenge that can really bring a business to its knees is bad debt – when a company doesn’t get paid the money owed to them by another business.

After a four-year period of dramatic rate correction across the UK and global insurance markets, average rate increases for insurers broadly returned to sing...

It is safe to say the cyber market continues to evolve at a pace, maybe not the breakneck speed of previous years, but nevertheless as we start to move into...

Are you looking for the right level of insurance coverage but don't want to spend too much time and effort on it? An insurance broker may help you find a bet...

Ramadan is one of the most important religious celebrations in the UK with over 3.3 million Muslim citizens potentially observing strict rules. It is importa...

What do businesses need to know about the Spring Statement that Jeremy Hunt, the Chancellor of the Exchequer delivered on 15 March 2023?

Our sister company, Towergate Health & Protection, have noticed an increase in heart attack claims from a younger demographic than before. With official figu...

Towergate is pleased to announce the launch of a new farm insurance affiliation with The Tenant Farmers Association (TFA).

Costs for materials and energy continue to climb in 2023, caused by a number of situations including the continued fallout from the Covid Pandemic, Brexit an...

Employers must invest in targeted wellbeing support to keep their workforce strong in 2023, says our sister company and part of the Ardonagh family, Towergat...

Businesses facing disruption is nothing new. Many are exposed to incidents ranging from minor to major all the time. This is why all business should have a r...

A wine and drinks supplier has been fined after a visiting HGV driver was killed after being hit by a forklift truck at its depot in Salford.

Did you know that 39%* of small businesses in the UK have suffered a cyber attack, and the average cost of a breach for SMEs is around £3,000? In today’s dig...

As the leaders of your organisation, your company’s director(s), manager(s), supervisor(s) and board member(s) could be held personally liable and may find t...

Businesses across the UK that are already struggling thanks to surging inflation and its knock-on effect on the cost of living, may not be able to survive th...

Until you need to make a claim, do you really know how good your insurance is? Can you be certain that your existing policies provide the right protection a...

Soaring inflation is hitting everyone hard. All industries, businesses and individuals are affected, and the insurance industry is no exception.

Advice on how to protect your businesses in the event of a potential power outage.

Prepare your business for winter with Towergate's guide to bad weather business continuity planning.

Simple tips to weatherproof your house for winter 1. Winterize the doors and windows · 2. House repairs · 3. Burst pipes · 4. Electrical installation · 5. Ch...

As your insurance broker our business focus is keeping you in business. We have helped our clients stay afloat when extreme weather events have damaged their...

Not sure what landlord’s insurance you need? Residential or commercial, mixed-use, or multiple premises we’ve got it covered.

Small businesses have possibly never faced more challenging trading conditions, but there are certain measures that SMEs can take that can help mitigate the...

And how owners are protecting their businesses against threats with the mounting pressure of the cost of living crisis

The number of companies relying solely on their own fleet of vehicles to provide mobility for their employees has been declining for several years. Conversel...

December is the month of celebrations for many of us as we head out to meet family, friends and work colleagues to enjoy the festivities. Before you head out...

As we approach winter, it’s important as a business, you begin to think about what might happen if more employees than usual are off sick or unable to get in...

Towergate are incredibly proud to share the news that for the third year running, they have been awarded the Investor in Customers (IIC) Gold award for 2022.

Road Safety Week takes place between 14th and 20th November 2022. The theme of Road Safety Week 2022 is SAFE ROADS FOR ALL, bringing together communities and...

Silicosis is a pathological condition of lungs, which is caused by inhalation of silica. This condition develops after exposure to silica dust over time. It...

New terrorism legislation is due to be introduced in the UK. A response to the suicide bombing at Manchester Arena on 22 May 2017 which killed 22 people and...

They are injuries or pain in the human musculoskeletal system, including the joints, ligaments, muscles, nerves, tendons, and structures that support limbs,...

US outdoor clothing retailer Patagonia made headlines when the owner Yvon Chouinard announced he was giving his company away to fight climate change.

The use of fork-lift trucks and power pallet trucks (FLT and PPT) are a significant boon to almost all operations, removing several risks and adding a level...

Yes – I’m afraid so ... it looks like health and safety madness. But I’m going to try and look at the risks, provide some food for thought (not Christmas pud...

There’s no way to sugar-coat it: there’s a cost-of-living crisis in the UK right now, and things are only going to get worse.

Whilst the UK has one of the safest environments in which to work, with realistically, very low incidents of fatalities, fatal accidents still occur and are...

Since most businesses in the UK now use the internet, email or cloud technology as an integral part of their operation, they become ever more reliant on tech...

FloodFlash surveyed 500 financial decision makers either at risk of flooding, or worried about the risk of flooding and 200 insurance brokers to find out wha...

W&I insurance can be obtained either by the buyer or the seller in a transaction to protect either party from unknown or unforeseen liabilities resulting in...

The Building Safety Act 2022 (the Act) became an Act of Parliament on 28 April 2022. It brings with it the most wide-ranging changes to building safety that...

Back in May 2022, The Architects Registration Board (ARB) released new draft guidance on the insurance cover architects must arrange to ensure they’re compli...

Listen to any weather update this week and you’ll hear it – the UK is experiencing a heatwave, with expected highs of over 30 degrees.

As fresh warnings are issued that up to 50% of businesses do not have adequate insurance, it’s important that commercial property owners take steps to check...

Starting your own small business is as exciting as it is nerve-wracking. Being your own boss is a great opportunity to enjoy the freedom of making key decisi...

It seems every time we go to the petrol station the cost of fuel is going up, from one day to the next, there seems to be a penny increase here and a penny i...

P&O has drawn widespread condemnation for the way it has dismissed around 800 employees from its ferry services in the UK. The affair has brought attention t...

The insurance industry has seen the arrival of an era of digital insurance transformation in response to changing customer needs and the Covid 19 pandemic.

One policy. One premium. One renewal date. Sounds simple, right? In this guide we’re stripping Commercial Combined Insurance back to basics to be just as it...

Self-care doesn’t have to be self-indulgent, and it’s not just for women. It’s a vital element of being a functioning person in society.

Data from our partners at FloodFlash suggests that British businesses are under serious threat. Are they aware of the threat though?

More and more litigation is being brought against individuals within business senior leadership teams who make decisions on behalf of the business.

Lynn Mildner, Towergate’s Director of Credit, explains how 2022 is looking mildly optimistic on growth but insolvencies will increase.

As inflation hits, it's never been more important to check the rebuild cost of your property - the implications of not having the right level of protection i...

Read our assessment of the UK and global insurance markets in 2022.

Simon Broome, Towergate’s Risk Manager, discusses the importance of your colleagues mental health and well being.

Marcus Alcock, editor of Emerging Risks focuses on the biggest threats, that he believes, businesses will be facing in 2022.

Friday, March 25th, 2022, will see existing mobile phones rules strengthened with a crackdown on drivers who use their mobile phones behind the wheel.

Gavin Snell, CEO of WorkNest, provides insight from their ‘Mind the Gap’ report, which evidences a divide between employer and employees across a host of emp...

Mark Brannon, Commercial Director at Towergate asks, is the now the time for ‘The Great Re-set’?

Your business flood risk factsheet. Time and tide wait for no one, so there’s no time like the present to be sure that you’ve taken the necessary precautions...

Underinsurance remains a hot topic across the UK - Will Molland of RebuildCostASSESMENT.com predicts how the risk of underinsurance will continue to grow in...

Using VR headsets at home may be great entertainment, but new statistics from Aviva have highlighted an increase in home insurance claims caused by VR-relate...

Extreme weather such as a storm can cause widespread damage to homes and businesses, leaving many of our clients needing our help simultaneously. If you’ve b...

We have had clients in Northern Ireland getting in touch to ask what their insurer’s stance is regarding the potential for ‘forced’ admissions to care homes...

Lindsey Nelson of CFC Underwriting, predicts how the cyber threat in 2022 will grow and how insurers need to prevent and respond as quickly.

It’s a common misconception that a holiday will solve employee burnout. But when we probe a little harder it’s easy to see why this logic doesn’t make sense.

The information on this page is provided by Capsticks for Towergate. Capsticks are specialists in defendant medical malpractice law and the below is a Roundu...

Heavy rain and gale force winds reaching more than 90mph, brought widespread flooding and storm damage to the UK on Sunday, courtesy of Storm Ciara.

A Cyber Security Breaches Survey by the Department for Digital, Culture, Media and Sport (DCMS) found that 39% of all UK businesses reported a cyber breach...

2021 has been another challenging year for businesses, with yet more disruption to “business as usual”. While life was slowly starting to get back to some fo...

The National Cyber Security Centre (NCSC) are urging UK organisations to bolster their cyber security resilience in response to malicious cyber incidents.

The British Heart Foundation have Released New Guidance on Performing CPR

The Highway Code has been updated to include new rules, in a bid to improve road safety for all users.

With the sale of non-electric cars ending in 2030, and hybrid sales ending in 2035 in the UK, the electric car question has been on many people’s lips – the...

We have written previously about the massive shortfall in insurance cover for UK commercial properties. RebuildCostASSESSMENT.com recently estimated that bui...

2021 has been another challenging year, with yet more disruption to “business as usual”. As many offices close their doors to employees once again, it is a g...

According to the British Retail Consortium, 2021, the HGV driver shortage is reported to have increased over the last five years from 45,000 in 2016 to 76,00...

The announcement of a new 1.25% tax hike to generate extra funding for the NHS is not the saving grace many wish it was.

As the nights draw in and jumpers come out for the autumn season, crispy golden leaves can look pretty, but can become a nuisance when they start to block yo...

The Mail on Sunday has reported a cyber attack on exclusive jewellery firm Graff. Cyber criminals are alleged to have leaked up to 69,000 confidential docume...

As the organiser of a fireworks display your liability insurance is for the safety of spectators and staff present during the evening. We have brought togeth...

Contractors have been left reeling by another huge materials price hike as a major concrete products manufacturer announced 15% increases.

Does your home insurance cover your new 'shoffice' and personal storage unit? With the increasing popularity of conversions to home offices, gyms, drinks bar...

The topic of climate change is not far away from most conversations, particularly given high-profile events and protests that have taken place. While the met...

Through a nationwide survey and an analysis of Spotify, Towergate have explored the relationship workers have with music while working.

September 2021 was a landmark month for all the wrong reasons, with businesses and consumers having to face up to further and significant challenges. It hard...

The UK construction industry is facing mounting pressure from the worst supply chain crisis in decades. Being driven by the fallout of coronavirus and Brexit...

While Brexit and covid-19 have led to supply chain issues and adapted business operations, the insurance implications of these are often not taken into accou...

For the last two years, the insurance market both in the UK and globally has been hardening at a rate not seen since 2001/02.

Preparation checklists and risk mitigation strategies for summer flooding, especially those that affect commercial properties.

In this article, we will look at some of the worst affected flooding areas, those most at risk and some of the worst recent floods (including flash flooding)...

In this article, we will look at some of the worst affected flooding areas, those most at risk and some of the worst recent floods (including flash flooding)...

Cyber insurance capacity is expected to reduce with some insurers exiting the cybermarket, resulting in higher rates, as insurers encounter both a higher fre...

A startling fact is that you are now more likely to go to a colleague’s funeral because they have killed themselves than because they died in a workplace acc...

Ratings agency Moody’s has given a stark warning that the UK should anticipate a rise in credit risks given the prospect of an unwinding of the level of gove...

Legal and rules changes associated with Whiplash Reforms came into effect on 31 May 2021. While it will take a bit of time for the insurance industry to full...

Arson and hot works are among the most common causes of fire in the UK, whilst modern methods of construction are also a leading factor in many fires. With t...

Learn more about email phishing and the importance of securing your online data. These top tips will protect you from potential hacks.

The end of the financial year is a busy time for businesses as they race to achieve their numbers, with many finance teams preparing for the tax season. This...

Cyber insurance capacity is expected to reduce with some insurers exiting the cybermarket, resulting in higher rates, as insurers encounter both a higher fre...

The Insurance Act 2015 was created to help you get fairer treatment from your insurer in the event of a loss or claim. However, the Act also stipulates that...

As the flood season heralds Storm Christoph, the Met Office has issued amber and yellow warnings as two months of rain is set to fall in just three days. Som...

As winter approaches, it is important that businesses are protected against adverse weather conditions. Read our checklists to help you.

Here we explore the UK’s flood landscape; why the risk is increasing; and examine the various measures and flood insurance available to help protect you and...

Read our article on the evolving nature of cyber risks and the changing landscape since the start of the pandemic; and what it means for you, including how t...

As we head closer to the holiday season, the threat of terrorism in the UK grows. Following a spate of attacks in Europe, UK alert levels have been upgraded...

Amidst the potential turmoil of another spike in infections from the coronavirus, the UK is facing the double whammy of its messy departure from the EU. Tow...

For more than a decade the insurance industry has operated in soft market conditions. Now, however, it is starting to experience a hardening market. That mea...

Towergate Insurance Brokers’ staff have been working tirelessly from 2,000 home offices, right across the UK, to support you during lockdown.

A right of light is an easement granted to a freeholder (or leaseholder or tenant, by assignment) which grants them the legal right to enjoy a reasonable amo...

The insurance market in the UK has been hardening at a rate not seen since 2001/02 and the Covid-19 pandemic has only accelerated this trend. This means that...

Coronavirus is impacting our lives in many ways and changing our routines. It has also caused the price of oil to fall meaning that both people and organisat...

Cybercriminals are likely poised to attack as Magento 1 reaches “end of life” leaving retailers highly vulnerable. After publishing a final security patch on...

Arrange your business insurance can be a time consuming and stressful process in normal circumstances, but with the UK insurance market hardening at a rate n...

Think of a ransomware attack and you may picture a hacker targeting employees who use laptops or desktop devices. Yet hackers are both opportunistic and reso...

Manchester United are suing the makers of the popular Football Manager series for allegedly infringing their trademark by using their name “extensively throu...

Insuring against the risk of terrorism and political violence after the Coronavirus lockdown may not be seen as a priority for businesses at this time, but t...

It has been highly publicised that Cybercriminals are exploiting the uncertainty that COVID-19 has brought, to their advantage. We first identified this back...

The insurance market in the UK is currently hardening at a rate not seen since at least 2001/02. This means that we are in the phase of the market cycle wher...

The past few weeks have seen widespread Black Lives Matter protests following the death of George Floyd in Minneapolis at the hands of police.

For the last two years, the insurance market both in the UK and globally has been hardening at a rate not seen since 2001/02.

A review of the conditions between 2017 and 2019 impacting the global (Re)insurance market and UK insurance market, plus some specific sectors of note.

Businesses are exposed to disasters all the time, including IT system failures, cyber incidents, power outages, major losses, i.e. fire or flood at site, epi...

With a new year comes new challenges. However, by looking at recent developments and current activities, there are clear trajectories on what might take grea...

The escalating situation around Covid-19 is demonstrating why it’s important for businesses to have in place a robust Business Continuity Plan (BCP) to ensur...

As a business, your top priority will understandably be keeping a competitive advantage and ensuring that you remain an attractive proposition for your clien...

Watches are highly collectable, take up little space and incur no Capital Gains Tax. As such they are becoming increasingly popular as an investment option....

More than half a million households using Creda, Hotpoint and Indesit washing machines have been urged to unplug them immediately due to the risk of fire.

When the HSE launched its controversial Fee for Intervention scheme in 2012, there were concerns that this was little more than a money raising exercise by t...

An investigation has been launched into the fire at a student accommodation block in Bolton on 15 November, which spread rapidly to the upper floors of the b...

It has been a torrid week in flood affected regions of England after the rivers Don, Severn and Avon burst their banks, with thousands of residents and busin...

The insurance market in the UK has been hardening at a rate not seen since 2001/02 and the Covid-19 pandemic has only accelerated this trend. This means that...

A recurring and entirely legitimate question from UK businesses is whether cyber insurance will pay out in the event of a claim. The recent reassuring answer...

With continued uncertainty over Brexit, but with the Government’s avowed intention to leave the EU by 31 October, freedom from Green Cards may come to a swif...

So called "ransomware" attacks against businesses have surged in 2019*, underlining the need for continuing vigilance against the growing threat of cyber attack

The government's decision to make only moderate changes to the system which sees courts determine how much insurers should pay out to claimants in cases of l...

With Brexit agreement hanging in the balance, and much to still surface on the precise nature of our departure arrangements, there are things that need to be...

Recent fires at premises as diverse as Ocado's distribution centre in Andover, Chester Zoo and most recently Notre Dame Cathedral, have been found to be caus...

The Homes (Fitness for Human Habitation) Act 2018 will give tenants new rights, including the ability to sue landlords who fail to adequately maintain their...

Towergate began its journey in 1997. Since then we have acquired many local insurance brokers, growing rapidly to become one of the UK’s largest insurance in...

Although investigators now say that the most likely cause of the recent devastating fire at Notre Dame was an electrical-short circuit, initial reports sugge...

One of the benefits of running a business as a Limited Company is the reassurance of ‘limited liability’. This means no personal liability for any financial...

A deep area of low-pressure, which will advance across the north of the UK late on Tuesday into Wednesday morning, has been named Storm Gareth. Gareth will b...

The UK is currently part of the European ‘free circulation zone’ meaning UK motorists can legally drive their vehicles in any European Economic Area (EEA) co...

In 2016, the CEO of FACC, a Chinese owned, Austrian-based aerospace parts manufacturer, was duped in a social engineering scheme that ultimately cost the com...

Shopping around for commercial insurance can be a time consuming and stressful process.

It’s that time of year again, with snow and ice on the way. And with cold weather comes the risk of burst pipes and escape of water. During winter, frozen pi...

Business Interruption Confusion continues and Underinsurance remains a key problem, suggests the CII.

Losing one vehicle due to fire can be a costly and disruptive event. Losing a fleet of vehicles due to fire spreading to several vehicles parked close togeth...

Directors of many of Britain’s companies may face large liability risks if unprepared for Brexit. According to insurance consultancy Mactavish, this will par...

Forecasters have warned of a repeat of last year’s Beast from the East until March. This time last year extreme weather stranded drivers on motorways, ground...

Businesses that stockpile goods in preparation for potential Brexit related disruptions are leaving themselves at risk of being underinsured.

Smaller companies are ‘losing talent’ to larger competitors because the benefits they offer are less attractive.

Insured or not? Directors face increasing defence costs and bigger fines

Bonfires and fireworks events can be popular fundraising opportunities but have the potential to cause damage and serious injury. If your school, charity or...

As a business owner you may have already experienced the time-consuming process and stress that can be associated to dealing with a claim.

After one of the hottest summers on record, UK insurers are now bracing themselves for a surge in subsidence claims.

Control your driver risks, protect more than your bottom line

Economic crime continues to be a major concern for organisations of all sizes, across all regions and in virtually every sector. One in three organisations r...

With no end in site for the current UK heatwave, for those in the leisure and tourism sectors 2018 could well turn out out to be one of the finest summers on...

World Cup £1.5BN insurance shines spotlight on cancellation cover.

A guide on how best to arrange your business insurance.

Cyber & Data - Digital technologies are an essential part of business today. All businesses rely on information technology (IT) infrastructure to some degree...

Following the recent terror attacks in Manchester and London, we’ve had some questions about insurance cover. Here’s how Group Income Protection, Group Criti...

Already under attack from several directions, including ever more stringent regulatory compliance and the threat of shareholder activism, the last thing that...

When disaster strikes, a quick effective response can be vital to keep you in business. Large losses can be complex and need assistance from experts.

Liability premiums set to reduce as Civil Liability Bill unveiled.

The technical bit. Regulation 7 of The Management of Health and Safety at Work Regulations 1999 states that “Every employer shall, subject to paragraphs (6)...

Risk Management can be challenging at the best of times. So we thought you might appreciate some useful tips..

3 reasons why you should talk to Towergate about your Private Client needs:

You will now be aware of the recent announcement about the liquidation of Carillion. With such a massive and complex failure, at this stage some of what is b...

The sudden collapse of UK construction conglomerate Carillion means that crucial steps will need to be taken by affected suppliers to ensure the best possibl...

Personal Accident and Business Travel delivers vital business interruption protection and helps customers meet their legal obligations. Additional services o...

UK insurance brokers have called on the Government to act quickly to implement changes to the system which sees courts determine how much insurers should pay...

Towergate Insurance Brokers is strongly committed to protecting clients from environmental risks. There is no substitute for experience and Towergate Insuran...

Construction professionals continue to be left in a state of some confusion, in the aftermath of the appalling fire at Grenfell Tower.

Our EXCLUSIVE Health & Safety portal that will help keep your business in great shape.

Valuation experts Barrett Corp & Harrington say “On average 77% of the properties they survey are underinsured by 45%”

Cyber Crime can affect any business. To view the informative video regarding the risk of cyber crime to your business select the link within the main story.

There are three key areas to a management liability policy, Directors and Officers Liability, Employment Practices Liability and Corporate Legal Liability....

It’s been a year of tumultuous news, from the unexpected death of David Bowie, the rise and fall – and rise again – of Boris Johnson, and most recently the e...

In his Autumn Statement, The Chancellor, Philip Hammond, unveiled plans to raise insurance premium tax (IPT) to 12% from 1st June 2017, up from the 10% previ...

On 4th May 2016, the Enterprise Act 2016 was passed. This new legislation provides policyholders with a potential right to claim for damages due to late paym...

If you answer yes to any of the questions asked in the attached document, then speak to us about Credit insurance cover

It should come as no surprise that the event that will have the most pressing consequences for Towergate clients (and underinsurance) will be the decision to...

The UK Government advises that the threat level from terrorism in mainland Britain for the UK is currently ‘Severe’, which is the next level up from ‘Moderat...

The Insurance Act 2015 represents a seismic shift in insurance law since 1906 and came into force on 12 August 2016. The requirements of the Act are exacting...

In recent years, we have experienced dramatic extremes weather wise in the UK. Storms are becoming more regular and more destructive, followed by soaring tem...

When the cold temperatures return, there are a number of new risks which present themselves. Protect your commercial property by developing your Business Con...

Eureka Capital Allowances identify and unlock hidden tax relief on parks that owners and their accountants have not or cannot claim. Capital allowances cost...

Are you a business property owner who's been missing out on a significant tax windfall? It's estimated that tens of thousands of pounds are being left unclai...